A few weeks ago, I was invited to the RDSP Discussion Group hosted by Mackenzie Investments Inc. Mackenzie is the top-notch company that provides many great resources in the RDSP planning. The event was held at their professionally designed office in downtown Toronto, and all participants were advisors from the financial industry who dedicated their practices on helping families with special needs.

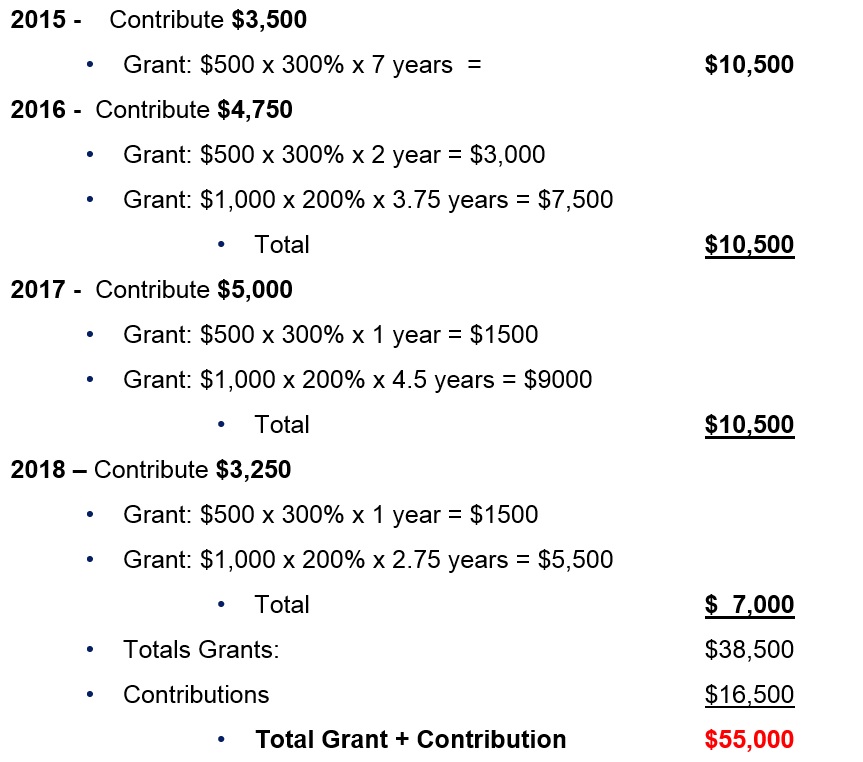

During our discussion, a presenter from the Mackenzie Tax & Estate department shows a very powerful example. This illustrates how one could hugely enhance and speed up their savings through the disability savings grants and bonds. Let’s go through it together now:

Tom is a 10 years old boy with prolonged physical disabilities, he has been diagnosed with this condition by his doctor since the year 2008. His doctor assisted him to fill out the T2201 form, and his disability tax credit was also approved by the CRA on the same year. Tom is living in a single family with his mother. Tom’s mother needs to spend a lot of time taking care of his daily activities, she could only afford to work part-time, hence throughout all the years, their family incomes are always lower than the first threshold on the CDSB table. (Click here to view the 2015 RDSP Income Matching Rates)

In year 2015, an RDSP account is setup, with the mother as the account holder, and Tom as the beneficiary. To catch up the carried grants from the previous years, her mother did the following:

In the above example, Tom’s mother redirect $16,500 of her savings, which leads to $38,500 of “Canada Disability Savings Grants”. But the benefits do not just stop here, because there is also the “Canada Disability Savings Bonds”. This bond provides extra benefit to low-income family, with up to $1000/year. In Tom’s example, from the year 2008 to 2018, government would deposit another $11,000 into his RDSP account, which boost the RDSP account total balance to be $55000+11000 = $66,000!

Rather than leaving the money in a regular savings account, which generate very little interest these days, this mother has successfully turned her savings of $16,500 into $66,000 in 4 years, which is a great milestone in building up the long-term savings for Tom.

Stay informed with our e-newsletter, where I share regular financial updates tailored specifically for Canadians with disabilities. Subscribe to stay ahead with financial insights that matter to you.

Disclaimer:

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as investment, financial, legal, accounting or tax advice. Please obtain independent professional advice, in the context of your particular circumstances. This newsletter was written, designed and produced by Samuel Li for the benefit of Samuel who is Advisors at : SamuelConsultant.com is a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. Investia is not liable and/or responsible for any non mutual fund related business and/or services.