In the past few years, I posted some examples on how to maximize in receiving the Canada Disability Savings Grants within the RDSP. This year will be no exception! Earlier today, I contacted the Mackenzie’s Tax and Estate team, and below is the illustration they have provided.

Before we jump into reviewing the figures, it’s important to understand there are several assumptions in this example.

Marty is a 7 years old boy with prolonged physical disabilities, he has been diagnosed with this condition by his doctor since the year 2008. His doctor assisted him to fill out the T2201 form, and his disability tax credit was also approved by the CRA on the same year. Marty is living in a single family with his mother. Marty’s mother needs to spend a lot of time taking care of his daily activities, she could only afford to work part-time, hence throughout all the years, their family incomes are always lower than the first threshold on the CDSB table (Click here to view the 2016 RDSP Income Matching Rates)

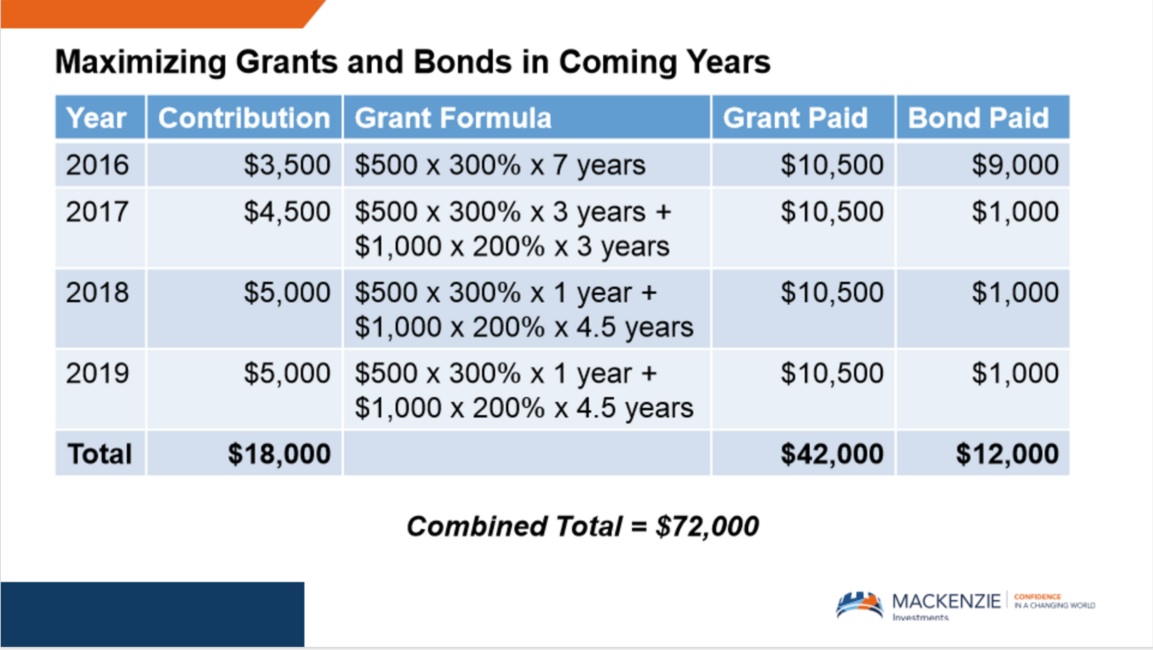

In year 2016, an RDSP account is setup, with the mother as the account holder, and Marty as the beneficiary. To catch up the carried grants from the previous years, her mother did the following:

In the above example, Marty’s mother redirect $18,000 of her savings, which leads to $42,000 of “Canada Disability Savings Grants”. But the benefits do not just stop here, because there is also the “Canada Disability Savings Bonds”. This bond provides extra benefit to low-income family, with up to $1000/year. In this example, from the year 2008 to 2019, government would deposit another $12,000 into his RDSP account, which boost the RDSP account total balance to be $18000+42000+12000= $72,000

Rather than leaving the money in a regular savings account, which generate very little interest these days, this mother has successfully turned her savings of $18,000 into $72,000 in 4 years, which is a great milestone in building up the long-term savings for Marty.

[note] Want more updates regarding the RDSP? Click here to subscribe to my e-newsletter. [/note]

- Disclaimer: The above figures are obtained from Mackenize Investments, only for illustration purposes, and not intend to provide specific financial advice. The amount of government grants and bonds one could receive depends on many factors such as the eligibility of the disability tax credit, family net income, age, therefore, they could be differed for each individual’s case. Market conditions, tax laws, and investment factors are subject to change. Individual should always consult with a financial professional before making any decision