The Registered Disability Savings Plan (RDSP) is a wonderful long-term savings program for Canadians with disabilities, that’s no question about it. Although I believe it’s grants and bonds make it one of the best programs we have in Canada, I also believe there is always room for improvements.

Therefore, a couple of weeks ago, I sent out an email asking my subscribers: “If you can change anything about the rules of RDSP, what improvements would you like to see?“.

I received a lot of feedback, and below are the top 6 suggestions.

1) Extend The Age Limit To Receive The Canada Disability Savings Grants And Bonds.

From time to time, I do receive inquiries about the RDSP from people who are aged over 49. As you might recall, the government grants and bonds are only payable until the end of the year in which the disabled person turns age 49. In other words, no benefits will be payable beyond that age. A few years ago, due to longer life expectancy, Government of Canada has postponed the mandatory withdrawal date of the “Registered Retirement Income Fund” (RRIF) from age 69 to age 71.

If they could do that for the RRIF, then why not for the RDSP? I wish I could help more disabled people to obtain the disability savings grants and bonds, rather than feeling sorry for them that they’re beyond the age requirements.

2) Raise Awareness Of The RDSP

If I remember correctly, the Tax Free Savings Account (TFSA) and the RDSP were launched around the same period of time. When you speak to the general public, most all of them have heard about the TFSA. (Well, although many still have no clues about the TFSA rules, but at least they have heard about it.), but not the RDSP.

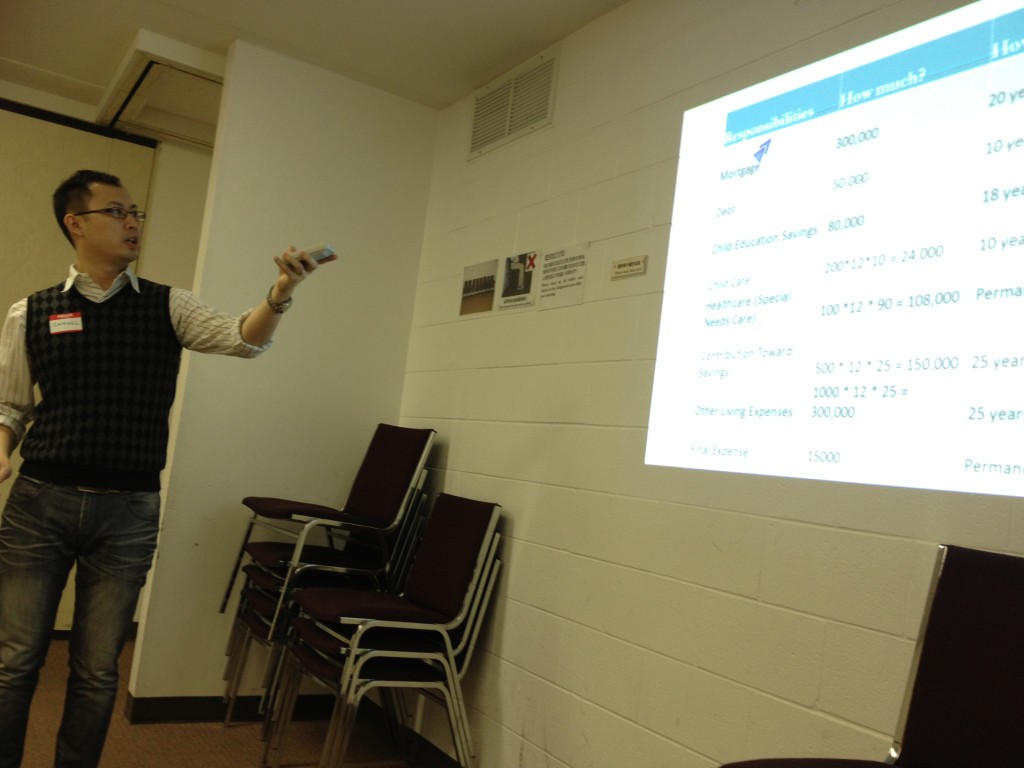

This is why I regularly host workshops for different special needs associations and local churches, attempting to raise the awareness of the importance in having the RDSP.

3) Retroactive Grants And Bonds That The Disabled People Were Entitled To

Remember what I just said about to extend the age limit to receive the grants and bonds. I did receive calls from quite a number of people saying that they had been qualified for the disability tax credit for many years, and they were still under age 49 at that time.

However, due to lack of awareness (back to point #2), when they realized there is such a program, they had already passed the age limit. If government could afford to provide them with the grants and bonds in those earlier years, then why not retroactive those benefits that they were entitled to receive?

4) Authorize Third Party To Obtain Grants & Bonds Details

When you are calling the CRA in regards to the tax information of someone else, you simply need that person to sign an authorization form, then you could speak on behalf of them. Since the grants and bonds are administered by another department, the Employment and Social Development Canada (ESDC), they do not have this option available.

Whenever I need to obtain details about my client’s grants and bonds status, we would have to set up a 3-way calls for that. The problem arises when the disabled person cannot speak on the phone, then we would have to mail a letter to request the information, then wait for them to response by mail again. We wish they could incorporate a third party authorization method, or at least have the email communication option available for the disabled person.

5) One Medical Application For All Disability Benefits

Many people believe they would be qualified for the “Registered Disability Savings Plan” because they have already been approved with other disability assistance programs such as the ODSP. However, this might not always be the case.

The reason is being qualified for the ODSP, does not mean one could be approved with the “Disability Tax Credit”, which is one of the requirements to setup the RDSP. Rather than visiting your doctor numerous times to fill out applications for different government benefits, wouldn’t it be great if you could do it in just one application?

6) Higher Standard Education Requirements

Financial planning for families with special needs requires a distinct, but sophisticated knowledge. Lack of in-depth knowledge will result in poor advice, which would damage the financial well-being of the families with special needs.

One of my clients who used to hold her RDSP account with another advisor. Her ex-advisor totally neglected the clawback rules and suggested that she could make the withdraw anytime without any consequence.

Fortunate that she consulted me for advice before she did that, or else, she would have to end up paying back a huge portion of the grants and bonds to the government. In US, there is a professional designation, “Chartered Special Needs Consultant” ChSNC, but not in Canada. I wish one day, there could be such a designation in Canada, that could raise the overall knowledge standard in servicing the special needs community.

Some Final Thoughts

The above are NOT the actual RDSP rules, they are just some feedback from the special needs community who wish the RDSP will eventually turn out to be in the future. There are other thoughtful suggestions such as shortening the claw back period from 10 years to 5 years, remove the withdrawal restriction when the disabled beneficiary has a short life expectancy.

Since I wrote this post a few years ago, there had been some enhancement to the RDSP- for example, even when the RDSP beneficiary no longer qualify for the DTC, the account can still remain open. Also, the list of Qualifying Family Member has expanded to include siblings.

So we’ll continue to voice out our opinion here. But whether the above are feasible solutions, let’s leave that to the policymakers to find out.

So what would you like to add to this wishlist? Feel free to leave me your comment below.

Stay informed with our e-newsletter, where I share regular financial updates tailored specifically for Canadians with disabilities. Subscribe to stay ahead with financial insights that matter to you.

Disclaimer:

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as investment, financial, legal, accounting or tax advice. Please obtain independent professional advice, in the context of your particular circumstances. This newsletter was written, designed and produced by Samuel Li for the benefit of Samuel who is Advisors at : SamuelConsultant.com is a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. Investia is not liable and/or responsible for any non mutual fund related business and/or services.