The Canada Education Savings Grant (CESG) from the Government of Canada will assist you to save for your child’s post secondary school. Your child can use the savings for full-time or part-time studies in a college, university, apprenticeship program, CEGEP, or trade school. This grant is based on contributions made to the RESP account and is comprised of two components:

- The Basic CESG

- The Additional CESG

What is the Basic CESG?

Basic CESG is a payment of 20% on RESP contributions made in respect of an eligible beneficiary, up until the end of the calendar year in which the beneficiary turns 17. Over 3 million children have already received the Canada Education Savings Grant. Contact me to register your child today!

What is the Additional CESG?

The Additional Canada Education Savings Grant (A-CESG) is extra money from the Government of Canada to assist you save for your child’s education after high school. This grant is in addition to the basic Canada Education Grant that you may already be getting in your child’s RESP.

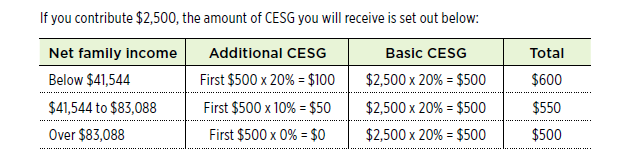

To accomplish this, the CESG provides an additional 20% on the first $500 for families with net incomes of less than $41,544 (2011 amount). For families with net incomes between $41,544 and $83,088, the additional grant is 10% on the first $500 of contributions.

Chart obtained from mackenziefinancial.com

Who qualifies for the CESG?

A beneficiary is eligible for the CESG up to the end of the calendar year in which they reach age 17, have a Social Insurance Number (SIN) and are a Canadian at the time of the RESP contribution.

If a child is between the ages of 15 and 17, special rules will apply. In order to continue receiving CESG after age 15, certain contributions must have been made to the RESP by December 31 of the calendar year in which the child turns 15. They include:

-

Total contributions of at least $2,000, or

-

Annual contributions of at least $100 a year or more in any of the four previous years.

What is the annual maximium CESG entitlement?

Since there is no annual contribution limit, you could contribute as much as you want in any given year up to a lifetime limit of $50,000. However, you must remember only the first $2,500 will attract the $500 maximum annual CESG. If you contribute less than $2,500 in a given year, any unused CESG contribution room will be be carried forward. The maximum annual CESG payment is $1,000 (contribution of $5,000) if you have unused CESG room from previous years. So please keep in mind, if you contribute less than $2,500 annually for too many years, you might not able to maximize the CESG entitlement.

For more details about CESG, contact me today!