Throughout my years as a financial advisor, I have had the privilege of serving many families with disabilities. Each family faces unique financial challenges, such as finding income support, government subsidies, tax benefits, and ways to save more money for disabled individuals.

Fortunately, Canada offers numerous benefits programs, but not everyone knows about them. I’ve researched and compiled this list to help. If you find this information useful, please share it with anyone who might benefit.

Stay informed with our e-newsletter, where I share regular financial updates tailored specifically for Canadians with disabilities. Subscribe to stay ahead with financial insights that matter to you.

Thank you for subscribing to our emailing list. We will send you an email shortly. To avoid our email landing to your junk folder, please remember to add our email Samuel@SamuelConsultant.com to your safe list. Thanks.

Nationwide Disability Benefits

Disability Tax Credit (DTC)

The Disability Tax Credit is a non-refundable tax credit for Canadians who have prolonged physical or mental disability. On the Disability Tax Credit Certificate, the definition of “Prolonged” is as “An impairment is prolonged if it has lasted, or is expected to last, for a continuous period of at least 12 months”.

Benefits: Tax reduction, making it a cornerstone for eligibility for other programs like the Registered Disability Savings Plan (RDSP) and the Child Disability Benefit.

Eligibility: Must have a prolonged impairment that significantly restricts daily activities, certified by a medical practitioner.

You may find out more details in these posts:

- Disability Tax Credit (Easy-to-Understand Guide)

- How to apply for the Disability Tax Credit? (approval tips that work)

Registered Disability Savings Plan (RDSP)

A program introduced by the Government of Canada back in 2008, with the purpose to assist Canadians with prolonged disability to build up their long term savings.

The two key benefits of this savings plan are:

- Canada Disability Savings Grants (CDSG): Matching grants which encourage contributing toward the RDSP account. Lifetime benefit is up to $70,000 per qualified individual.

- Canada Disability Savings Bonds (CDSB): Deposits from government for low-income families with disability. No contribution is required. Lifetime benefit is up to $20,000 per qualified individual.

Eligibility: Available to Canadians under 60 with a severe and prolonged disability, eligible for the Disability Tax Credit.

Note: The CDSG and CDSB are available until the end of the year that the beneficiary reaches age 49. The amount may vary among individuals as it depends on numerous factors such as age, contribution amount, family income, and qualifying years of the DTC.

As a financial advisor, I’ve had the privilege of working with Canadians with disabilities over many years, I’ve observed that many families are still unfamiliar with the Registered Disability Savings Plan (RDSP) due to its complex rules. >> Here’s a comprehensive guide addressing common questions about RDSP <<

Child Disability Benefit

The Child Disability Benefit (CDB) is a tax-free monthly income for families who care for a child under age 18 with a severe and prolonged impairment in physical or mental functions. The child must be approved with the disability tax credit. The amount of benefit will be subjected to the number of children with disabilities and the family income.

For more details, please visit: https://samuelconsultant.com/child-disability-benefits-cdb/

Canada Pension Plan (CPP) Disability Benefits

Canada Pension Plan (CPP) provides disability benefits to people who have made enough contributions to the CPP and who are disabled and cannot work at any job on a regular basis. Benefits may also be available to their dependent children.

Benefits: Monthly payments based on your contribution history.

Eligibility: Must be under 65, have made sufficient CPP contributions, and have a severe and prolonged disability. Application involves submitting the CPP disability application form and medical information form, both of which require detailed information from a healthcare provider.

For more details, please visit: https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-disability-benefit.html

Canada Pension Plan Disability Vocational Rehabilitation Program

The Disability Vocational Rehabilitation Program is a voluntary program that helps Canada Pension Plan (CPP) disability benefit recipients return to work. If you are receiving a CPP disability benefit, you may be eligible for vocational counseling, financial support for training, and job-search services.

For more details, please visit: https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-disability-benefit/vocational-rehabilitation.html

Veterans Affairs Canada (VAC) Disability Benefits

The Veterans Affairs Canada (VAC) Disability Benefits program compensates members and veterans of the Canadian Armed Forces and the Royal Canadian Mounted Police for service-related illnesses or injuries.

Benefits: A disability benefit is a tax-free, financial payment to support your well-being. It could be life-time monthly benefit or lump sum benefit. The amount would be based on the Pain and Suffering Compensation rate.

Eligibility: Open to members and former members of the Canadian Armed Forces or RCMP, and certain civilians associated with military activities, who have a service-related injury or illness.

Application Process: Applicants need to gather relevant medical and service documents, complete the application form available on the VAC website or through a VAC office, and submit it online via My VAC Account, by mail, or in person.

For more details and to apply, visit the VAC Disability Benefits page.

Benefits Specifically for Canadians in Ontario

Ontario Disability Support Program (ODSP)

- To assist disabled persons with financial needs to pay for their living expenses such as housing and food. This program offers assistance in two ways, which is the “ODSP Income Support” and the “ODSP Employment Support”.

- For more details, please visit https://samuelconsultant.com/ontario-disability-support-program-odsp/

Accessible Parking Permit (APP)

The Accessible Parking Permit (APP) is designed to provide an easier way to get access to different locations for people with disabilities. A valid permit must be shown clearly on the vehicles’ sun visor or front dash.

For more details, please visit: https://samuelconsultant.com/accessible-parking-permit-ontario/

Bursary For Students With Disabilities (BSWD)

The objective of this bursary is to assist students with either temporary or permanent disabilities who incur extra costs due to their special needs. These expenses could be educational costs for services or equipment. For example, note-takers, interpreters, tutors, braillers or other technical aids. These costs must not be already covered by another agency or service and are needed in order to participate in post-secondary school.

For more details, please visit: https://samuelconsultant.com/ontario-bursary-disabilities/

Community Support Services

Community Care Access Centres coordinate services for seniors, people with disabilities and people who need health care services to help them live independently in the community. Staff at the centres provide information and coordinate professional, personal support and homemaking services for people living in their own homes, and for school children with special needs.

For more details, please visit: https://www.ontario.ca/page/community-support-services

Assistive Devices Program

The objective of the Assistive Devices Program (ADP) is to provide consumer centered support and funding to Ontario residents who have long-term physical disabilities and to provide access to personalized assistive devices appropriate for the individual’s basic needs.

Devices covered by the program are intended to enable people with physical disabilities to increase their independence through access to assistive devices responsive to their individual needs.

For more details, please visit: https://www.ontario.ca/page/assistive-devices-program

Special Services At Home (SSAH)

The Special Services at Home program helps families who are caring for a child with a developmental or physical disability. It is funded and managed by the Ministry of Community and Social Services.

The program helps families pay for special services in or outside the family home as long as the child is not receiving support from a residential program. For example, the family can hire someone to:

- help the child learn new skills and abilities, such as improving their communications skills and becoming more independent

- provide respite support to the family – families can get money to pay for services that will give them a break, or respite, from the day-to-day care of their child.

For more details, please visit: https://www.ontario.ca/page/special-services-home

Assistance for Children with Severe Disabilities (ACSD)

If you are a parent caring for a child with a severe disability, you may be able to receive financial support through the Assistance for Children with Severe Disabilities Program. This program provides financial support for low- to moderate-income families to cover some of the extra costs of caring for a child who has a severe disability.

For more details, please visit: https://www.ontario.ca/page/assistance-children-severe-disabilities-program

Other Programs & Resources for Children with Special Needs

- Ontario Autism Program

- Children’s rehabilitation services

- Mental health services for children and youth

- Fetal alcohol spectrum disorder

- Respite programs

- Special education in Ontario schools

- Ontario Centre of Excellence for Child and Youth Mental Health

Passport Program

The Passport Program is a government initiative in Ontario that provides funding to adults with a developmental disability to help them live more independently and participate in their communities. This program also supports caregivers by providing funding for respite services.

Benefits: The program offers funding that can be used for community participation services such as recreational activities, life skills training, and personal development. It can also cover costs associated with caregiver respite, giving temporary relief to primary caregivers. Here’s the funding table to determine the funding amount.

Eligibility: To be eligible for the Passport Program, individuals must be 18 years of age or older with a developmental disability. Eligibility is determined through Developmental Services Ontario (DSO), which assesses the needs of the individual. Interested individuals or their caregivers need to contact their local DSO office to initiate the assessment process, which will determine their eligibility and the amount of funding they can receive.

For more detailed information and specific guidance on the application process, please visit https://www.ontario.ca/page/passport-program-adults-developmental-disability

Provincial Land Tax Deferral Program for Low-Income Seniors and Low-Income Persons With Disabilities

Low-income seniors and low-income persons with disabilities can get a partial deferral of provincial land tax and education tax. The tax deferral applies to the tax increase in the current year and not to outstanding taxes.

For more details, please visit https://www.ontario.ca/document/provincial-land-tax/provincial-land-tax-deferral-program-low-income-seniors-and-low-income

Charitable Organizations

Village Eulogia

Village Eulogia is a community-focused organization dedicated to supporting families with children who have special needs. They provide a range of programs and services designed to meet the unique challenges these families face, fostering an inclusive and supportive environment. Their offerings include family camps, support groups, and various resources aimed at promoting the well-being and development of both children with special needs and their families.

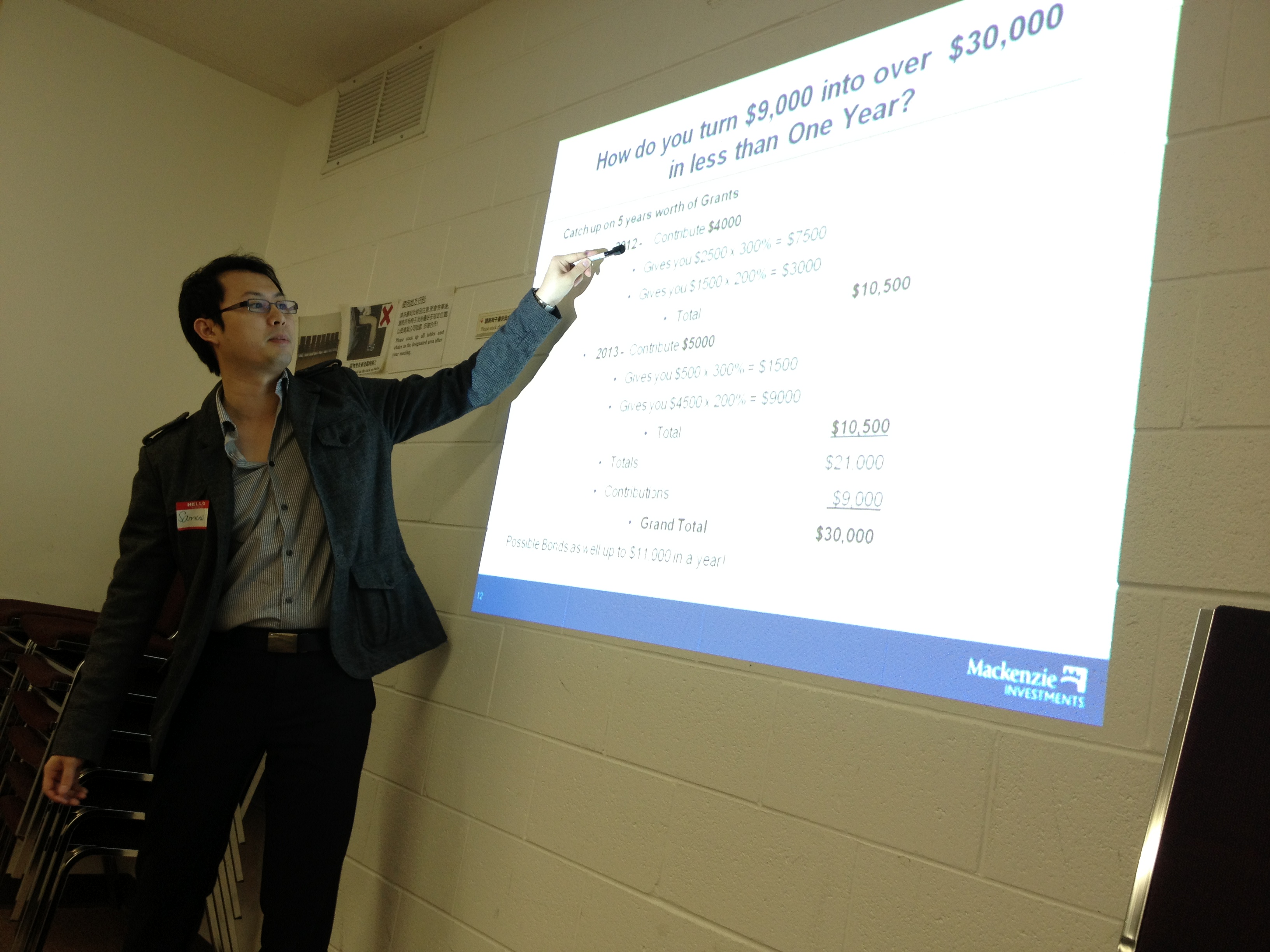

I have had the privilege to participate in some of Village Eulogia’s events before, which provided valuable insights and community connections. Additionally, I have been a guest speaker at one of their events, sharing my knowledge on the Registered Disability Savings Plan (RDSP) to help families understand and navigate this important financial resource.

These valuable opportunities allow me to contribute to and learn from a community that champions inclusivity and support for families with special needs children.

For more information about their programs and how they support families, you can visit their website: Village Eulogia.

Yasad Fellowship Of Scarborough Chinese Alliance Church (SCAC)

This is a Christian fellowship that mainly connects families with special needs in the Cantonese community. They have gathering once per month in the Scarborough region. I’m delighted to be one of their guest speakers for several years. If you wish to obtain more information, here’s the link to their website.

Jennifer Ashleigh Foundation

JACC has helped almost 15,000 seriously ill children and their families with funding for hospital and household costs, specialized care, medical treatments and therapies. They are unique and different from other children’s charities in that;

- React quickly to requests and in emergency situations, often within 24 hours

- Act as a “safety net” for Ontario children when all other resources have been exhausted

- Take an individual approach to financially assisting the children that are referred to us

- Do all their own fundraising. Receive no government or United Way funding

Funds are used to assist seriously ill children within our Crisis, Care, and Wellness Programs.

CRISIS: Assistance to relieve the financial stress associated with caring for a special-needs child.

CARE: Assistance with the cost of specialized care which includes one-on-one respite care.

WELLNESS: Development/intervention programs, which maximize the developmental potential of the child, and specialized medical treatment and supplies not covered by government funding or private insurance.

For more details, please visit: http://jenash.org/about-us/our-purpose/

Learning Disabilities Association of Peel Region

Learning Disabilities Association is charitable, non-profit organization dedicated to improving the lives of children, youth and adults with learning disabilities.

Their strength comes from the community with members and volunteers from all walks of life supporting their organization with a passion for helping people with learning disabilities and their families achieve their potential.

Please visit: http://www.ldapr.ca/

Final Thoughts

There could be other benefit programs I haven’t covered, so I’ll continue to expand on the list. Be sure to save this page and revisit it.

Once again, if you find this information useful, please share it with anyone who might benefit. Thanks!

Stay informed with our e-newsletter, where I share regular financial updates tailored specifically for Canadians with disabilities. Subscribe to stay ahead with financial insights that matter to you.

Thank you for subscribing to our emailing list. We will send you an email shortly. To avoid our email landing to your junk folder, please remember to add our email Samuel@SamuelConsultant.com to your safe list. Thanks.

Disclaimer:

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as investment, financial, legal, accounting or tax advice. Please obtain independent professional advice, in the context of your particular circumstances. This newsletter was written, designed and produced by Samuel Li for the benefit of Samuel who is Advisors at : SamuelConsultant.com is a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. Investia is not liable and/or responsible for any non mutual fund related business and/or services.