If you or someone in your family has a severe and prolonged disability, you should check out the Disability Tax Credit.

The disability tax credit (DTC) is a non-refundable tax credit. It may be used to reduce the income tax and also open up the doors to several disability-related benefits.

Throughout my practice, I’ve seen many families successfully get this tax credit approved, and it truly helped their finance. But I also realized many disabled individuals are reluctant to apply since they are unsure what this is all about.

So I want to write this post covering all the common questions about the disability tax credit, and I’ll try to make it as easy to understand as possible.

Who qualifies for the disability tax credit?

According to the Government of Canada, an individual may be eligible for the DTC if they have a severe and prolonged disability. This impairment can be related to physical or mental functions.

What conditions qualify for the disability tax credit in Canada?

When qualifying a disability tax credit application, the CRA will review whether the applicant has a condition that “marked restriction” or “significant limitations” in walking, dressing, feeding, eliminating (bowel or bladder functions), hearing, speaking, vision, mental functions or require life-sustaining therapy.

Of course, they don’t require applicants to have all the listed impairment conditions. They only require you to be either:

- “marked restriction” in 1 of the categories, OR

- “significant limitations” in 2 or more categories, OR

- receive therapy to support a vital function.

To give you an example, I have been working with a middle-aged lady with chronic pain. Her pain is so severe that she cannot put on clothes or shoes by herself. And even though she is already receiving treatment, taking medication, and having assisted devices, her situation has not improved.

A few years ago, she applied for the DTC and got it approved. Although I wasn’t involved in the application process, it’s reasonable to assume that the approval was based on the marked restriction on “Dressing.”

Not sure what it means by “marked restriction” and “significant limitations”? Don’t worry! I’ll cover that in an upcoming post: “Practical tips when applying for the DTC. (That actually works)”

Does Type 1 diabetes qualify for the disability tax credit in Canada?

Yes, the good news is that CRA has widened the criteria in 2022. Applicants diagnosed with type 1 diabetes are now deemed to meet the criteria for life-sustaining therapy.

Is there an age limit for the disability tax credit?

There is no age limit. The DTC can apply to anyone.

What are the benefits of the disability tax credit?

Disability tax credit benefit #1: Reduce income tax

If you have taxable income, you may use the DTC to reduce your income tax. For 2022, the federal non-refundable disability amount is $8,870 for an adult.

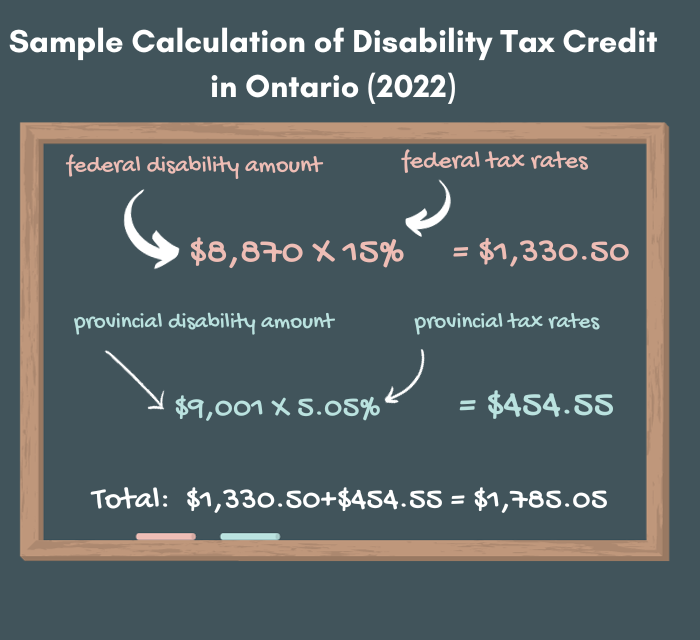

However, to determine the actual disability tax credit, you need to multiply the federal and provincial disability amounts by the lowest federal and provincial tax rates to determine the actual disability tax credit.

Since I’m from Ontario, let’s do a sample calculation of how the disability tax credit would work in here.

For a disabled child under age 18, there is an additional supplement of up to $5,174.

I know this might seem rather complicated, so this is just to give you a general concept. When you do your tax filing, just let your accountant know about the disability tax credit. A qualified tax professional should be able to report it correctly for you.

If you’re filing it yourself, you should look into Line 31600 – “Disability amount for self.” A few of the families that I work with use software such as UFile to do their tax filing and have no problem claiming the disability tax credit.

Disability tax credit benefit #2: Backdate tax refunds

The disability tax credit can be backdated up to 10 years or the date that the disability condition has met the approval criteria, whatever the latter.

To give you an example, a client that I work with has a son with autism. The son is in his early 30s, and his autistic condition met the DTC criteria when he was still a child. However, they did not know about the disability tax credit until recently, so when they apply, the earliest time CRA could backdate to is up to 10 years.

On the other hand, I work with another lady with a mobility disability. Her doctor confirmed that her condition was developed only five years ago. Therefore, her disability tax credit was backdated for five years.

But either way, when multiple years of backdating are involved, that could be a good chunk of money. This is why you may see some ads claiming to help Canadians with disabilities get thousands of tax refunds. I believe that is what they are implying.

Disability tax credit benefit #3: A door to other benefits

Far too many times, I’ve heard people saying, “I don’t have any income, so the disability tax credit is useless to me.” But this is not necessarily true. In fact, in most of the cases I’ve encountered, a qualified person not applying for the DTC would miss out on lots of benefits.

The disability tax credit is a prerequisite for many disability programs from the Government of Canada. For example,

- Registered Disability Savings Plan

- Canada Disability Savings Grants and Bonds

- Child Disability Benefits

- Canada Pension Plan disability benefits

- Disability Benefits for Veterans

Who should claim the disability tax credit?

If the disabled person has income, they would be the first one to claim the disability tax credit. If there’s any reminder, it may be transferred to a spouse (line 32600)

I have had a chance to work with a stay-at-home wife recently. Her DTC was approved due to her mobility issue. Although she spends most of her time at home, she also takes up small freelance jobs now and then.

Despite the fact that her husband’s income is significantly higher than hers, the wife with the disability would need to claim the DTC first. Then her husband could claim any unused portion.

Furthermore, if a disabled person doesn’t have a spouse, another option is to transfer the disability amount to the person that they depend on.

A dependant may be:

- Your parent, grandparent, child, grandchild, brother, sister, aunt, uncle, niece, or nephew OR

- Your spouse’s or common-law partner’s parent, grandparent, child, grandchild, brother, sister, aunt, uncle, niece, or nephew

Depending on your situation, you may look into line 30400 or 30450. But be sure to consult with your accountant for your specific tax situation.

Is the Disability Tax Credit a one-time payment?

The disability tax credit refund is usually a one-time payment. Even when there is backdating from previous years, if the tax adjustments were being requested at the same time, the CRA would send out the refund all at once.

For more convenience and quick turnaround time, you may register for the online payment option. This way, the money can be electronically transferred to your bank account and eliminate the mailing process.

But I’m just talking about the refund when you initially applied for the DTC. As long as your DTC remains active, you can continue to use it to reduce your income tax.

How to apply for the disability tax credit in Canada?

To apply for the disability tax credit, you and a qualified medical practitioner must fill out the T2201 form.

Part A is to be filled out by you, where you’ll input your personal info such as name, mailing address, SIN, and the person who will claim the disability amount.

Part B is to be filled out by a qualified medical practitioner, who will detail your disability condition.

Once the form is completed, you may mail it to the CRA or submit it online through CRA’s My Account.

This is just a simplified way of explaining the application process, and there is a lot more to it. Here’s another guide focusing on how to apply for the disability tax credit. In there, I’ll share helpful tips and first-hand experience from families who got their DTC approved.

Stay informed with our e-newsletter, where I share regular financial updates tailored specifically for Canadians with disabilities. Subscribe to stay ahead with financial insights that matter to you.

Disclaimer:

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as investment, financial, legal, accounting or tax advice. Please obtain independent professional advice, in the context of your particular circumstances. This newsletter was written, designed and produced by Samuel Li for the benefit of Samuel who is Advisors at : SamuelConsultant.com is a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. Investia is not liable and/or responsible for any non mutual fund related business and/or services.