Planning for your employees in the long run with Group RRSP

A Group RRSP is a collection of individual RRSPs where an employer assists employees by handling their contributions through regular payroll deductions on a pre-tax basis. As government is gradually shifting the responsibility of retirement savings back to individuals, many employees are starting to view this as a mandatory component of their benefit package. There are several reasons why more and more companies are looking into providing group pension plans.

- Increase Loyalty and Reduce Turnover: The better employees are being treated, the more respect they would have to their company. Having a group retirement plan in place helps attract and retain qualified individuals. Some employers would impose a 2 years vesting period on the group plan as a way to encourage employees to stay working long-term with the company.

- Increase Productivity: There are many cases where employees are managing their personal finance during work hours. They may be reviewing over their investments or even placing trades in the workplace. Having a financial consultant to manage their finance through a group plan, your employees could focus on working for your company.

- Accumulated Appreciation: If you are not providing a group plan to your employees, what are the alternatives? Perhaps, you will give your employees a bonus. However, how long will that appreciation last? Many people have short-term memory when it comes to appreciating another one, especially after the money is spent. By having a group RRSP, whenever your employees look at their statements with the accumulated savings, they would recall what the company has done for them.

To see if Group RRSP the right choice for your company, feel free to contact me.

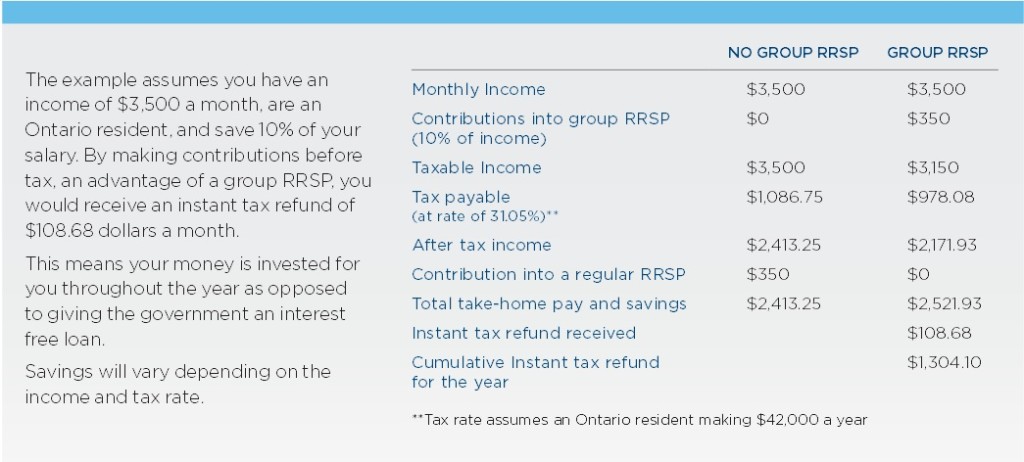

The member realizes instant tax savings because the contribution is deducted from earnings before tax is calculated. Here are a few basic rules for Group RRSP.

- A Group RRSP is designed to shelter taxes on any gains made until retirement, at which point the member is usually at a lower marginal tax bracket

- Employees can invest 18% of your previous year’s earned income up to a maximum of $20,000 in 2008 and $21,000 in 2009

- Employee contributions are often matched by the employer (generally to a maximum of 3-5% of earnings). However, employer’s contributions are not mandatory. Contributions by the employer are taxable as income to the employee.

- Spousal accounts can be setup within a Group RRSP. Contributions would be made by the higher-earning spouse to the plan of a lower-earning spouse, as long as the contributor is an employee of the company. This option allows for withdrawals at retirement at the lower-earning spouse’s tax rate

Below is an instant tax savings Group RRSP example quoted from Mackenzie Investments:

How could I assist you with your Group RRSP?

There are many financial institutions that could administer the Group RRSP, but not all of them could provide the attention that your employees need. Being a professional financial consultant, my strength is in listening to the needs of all my clients and assist them accordingly. I will assist your employees in managing their group retirement savings. With the right asset allocation, their money will be invested in such a way that align with their retirement goals. In making sure your employees will continuously satisfied with the group plan, we could hold lunch sessions periodically in attempting to answer any questions or concerns that they might have. I could also be reached anytime when they need further assistance.

Should you wish to discuss further, I welcome you to contact me