I hope you had a wonderful holiday season and a Happy New Year! As we kick off 2025, I wanted to take a moment to reflect on the incredible year we’ve just had. Many of my clients have enjoyed significant gains in their portfolios, and I’m excited to have a review discussion with you as we move into the new year.

So, how should we position your portfolio moving forward? I’ve read through numerous commentaries from reputable investment management companies, and the consensus is that 2024 saw strong stock returns driven by a rare “Goldilocks” scenario: solid earnings growth paired with rising price-earnings ratios.

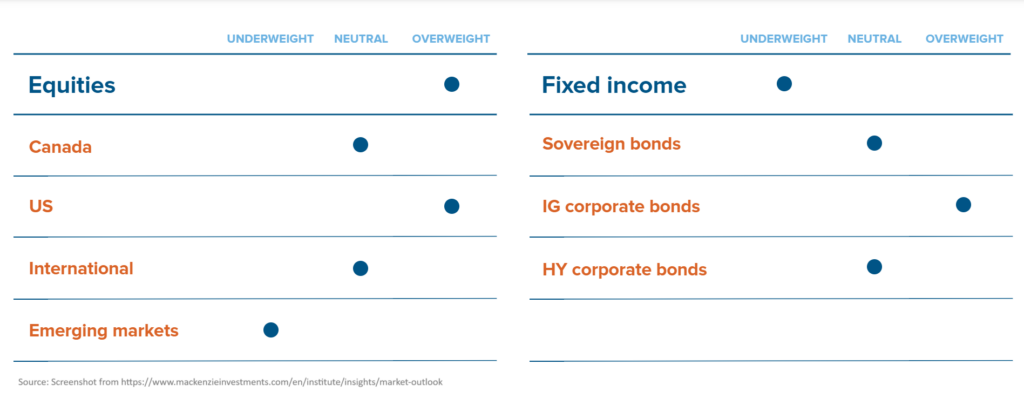

Although it’s uncertain whether we will see the same magnitude of growth, many expect equities to continue rising in 2025, driven by solid corporate earnings growth and easing financial conditions. On the other hand, fixed income may face challenges in a more divergent policy setting, which is something to consider when positioning your portfolio.

While charts like these offer valuable insights, it’s important to remember that market predictions are not guarantees. Conditions can change quickly, so staying responsive and aligning strategies with your individual suitability is key to successful long-term investing.

One area to keep an eye on this year is the potential of tariffs or trade policy changes from the U.S., which could impact global trade and contribute to inflationary pressures. While this could influence market conditions, it’s something we can monitor closely.

It’s important to select an investment management team that understands these trends and has experience in guiding portfolios through changing market conditions. Here are some valuable insights from our trusted partners:

- What’s ahead for stocks in 2025 (Fidelity Investments)(Article)

- 2025 Market Outlook (Mackenzie Investments) (Bluebook)

- The Mechazilla Moment – 2025 Global Market Outlook (Russell Investments)(Video)

When it comes to investments, it’s important to build a portfolio that is suitable according to your objective, risk profile and time horizon. If you are looking for investment advice from a trusted professional, you may CLICK HERE to gain a better understanding of our investment planning process.

Disclaimer:

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as investment, financial, legal, accounting or tax advice. Please obtain independent professional advice, in the context of your particular circumstances. This newsletter was written, designed and produced by Samuel Li for the benefit of Samuel who is Advisors at : SamuelConsultant.com is a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. Investia is not liable and/or responsible for any non mutual fund related business and/or services.