Last Monday, I did a workshop on personal finance for self-employed professionals at the YMCA. It was a great turnout! We have attendees from across different industries (i.e.: health, beauty, flower shops, computer repairs and many others.) As we are approaching the deadline to make the RRSP contribution for the tax year 2013, I received many insightful questions regarding this topic. One key idea I particularly emphasis on it’s the importance of having a well-diversified portfolio when planning for your RRSP.

Investment Planning for your RRSP

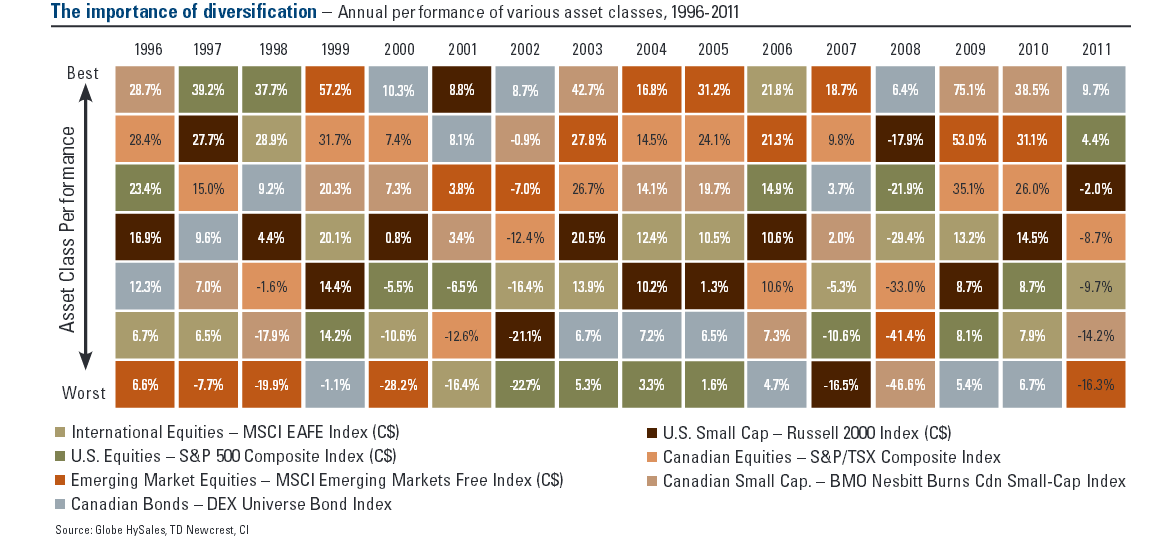

From time to time, many investors attempt to speculate what will be the next hottest investment. However, as shown in the diagram below, market timing successfully is extremely difficult to be achieved on a consistent basis. For example, in year 1996, Canadian Small Cap was the best performing sector returning 28.7%, the following year, its return had decreased to 7.0%, in year 1998, it actually generated a negative return of 17.9%. Let’s look at another example, the emerging market equities had been the worst performing sector from year 1996 to 1998, then it suddenly turned to be the best in 1999, then it turned back into the worst in year 2000.

I’ve seen many investors who make their investment decision solely based on what they read on the headlines. I’m not saying the headlines are always incorrect, but many times the information may not be first handed, which means the market might already reacted to these information before you even know about it.

“If investments headlines are always correct, shouldn’t the richest people are those who write them?”

Furthermore, everyone’s financial situation is different, just because an investment has good growing potential, doesn’t mean it will be suitable for you. There are many different factors that need to be taken into consideration. Am I comfortable with the volatility this investment would have? What are the downsides? Will this generate the amount of income that I need? What are the tax implications for this investment?

For long-term investing, my approach would be to build a well-diversified portfolio that aligns with my goals and risk tolerance, while monitor and re-balance it on a regularly basis.