1) Find out who should be the RDSP account holder

The account holder is the person who could make all the decision regarding the Registered Disability Savings Plan. (i.e.: Decision on investments, contributions, withdrawal). It is important to assign an account holder who could make legal and rational decision on behalf of the beneficiary.

According to the current rules, when the beneficiary reaches the age of majority. (Age of majority is 18 in Ontario, but could be different across provinces)

If the beneficiary has contractual competency, then the beneficiary will become the account holder.

If the beneficiary lacks the capacity to enter into a contract, then account holder will be the beneficiary’s guardian or legal representative. A temporary solution is in place allowing a “qualifying family member”, including spouses, common law partners and parents, to be account holders without being legal representatives or guardians.

“This temporary measure came into force on June 29, 2012 and will expire on December 31, 2018. An individual who becomes a holder of an RDSP under these rules will generally be able to remain the holder of the RDSP after 2018. After 2019, a qualifying family member will only be able to open a disability savings plan, because he/she is transferring an existing plan for which he/she is the holder.” Quote from http://www.esdc.gc.ca/eng/disability/savings/issuers/user_guide/section2.shtml

Below is another article which could be helpful to you:

How To Plan For Disabled Adults Who Are Unable To Manage Their Finance?

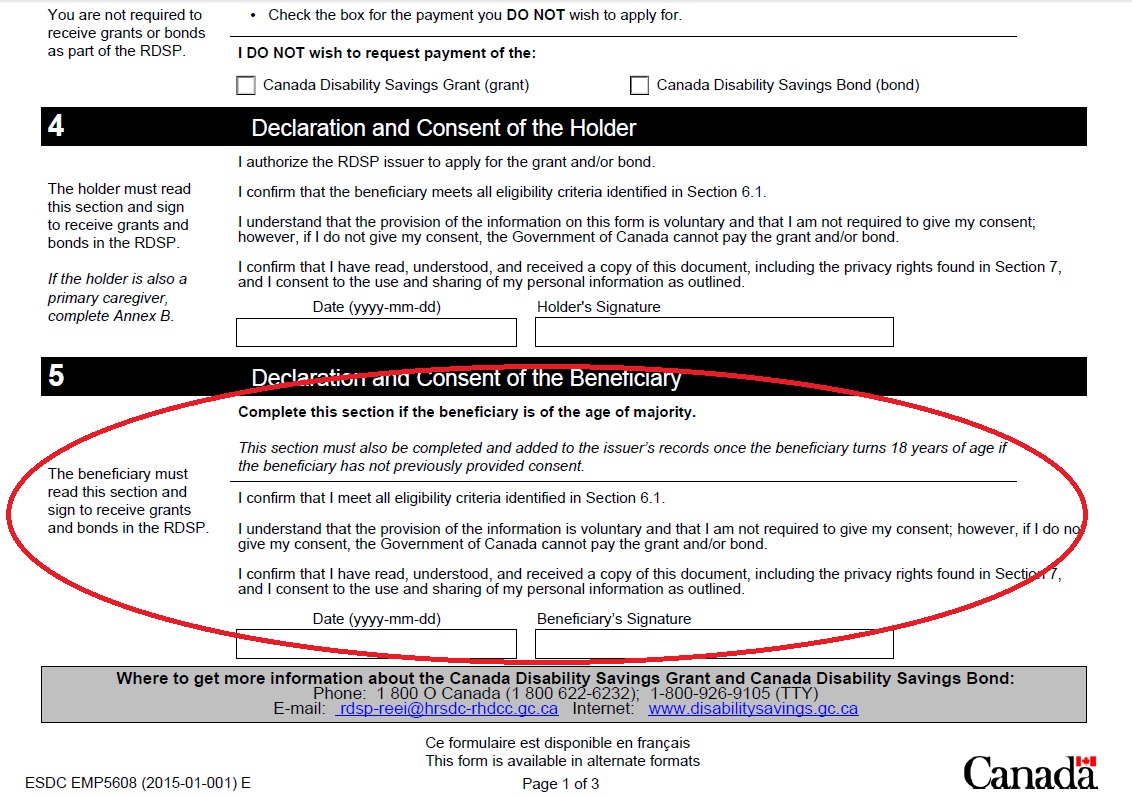

2) Sign the Canada Disability Savings Grants And Bonds Application

Although in most instances, the Canada Disability Savings Grants and Bonds application was already signed at the time the RDSP account was opened. However, when the beneficiary reaches the age of majority, the ESDC department would require the beneficiary to sign the Canada Disability Savings Grants and Bonds application. If beneficiary lacks the capacity to enter into a contract, the approach similar to the above discussion will be used to determine whom to sign the beneficiary’s section.

3) Start The Tax Filing No Later Than The Year That The Beneficiary Reaches Age 17

There are other factors which might affect the procedures that need to be taken. (i.e.: Is the child living with the parents or in a group home?). Therefore, each situation could be unique and it is important to consider all the different factors before taking any action. If you need any assistance, feel free to contact us.

Disclaimer:

- Information is posted on Aug 25, 2016, but it is subjected to change.

- Most details are found on http://www.esdc.gc.ca/eng/disability/savings/issuers/user_guide/section2.shtml and phone call was made on the Employment and Social Development Canada (ESDC) on Aug 22, 2016. Although we did our best to confirm the above details, it is not guaranteed to be error-free.

- Above information is only for general understanding, please always consult a financial or legal professional before making any decision.