1) Open your RDSP account ASAP

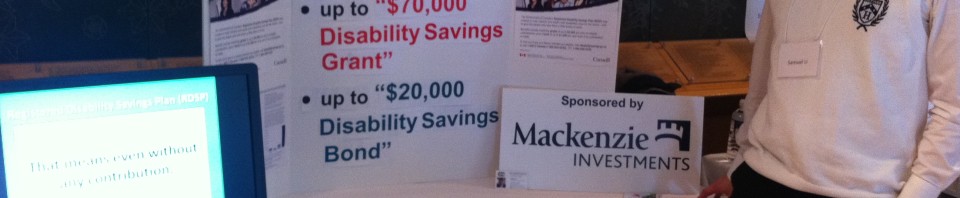

I have been working in the financial industry since 2005, and the Registered Disability Savings Plan is truly one of the best financial programs I have ever seen. This is an excellent program in the sense that it provides attractive matching grants and savings bonds. Where else could you find free money of up to $90,000? Since the Government of Canada encourages long time savings, there is waiting period in which the disability savings grants and bonds would have to stay within the RDSP account. The earlier you receive the government money in your RDSP, the earlier you could use it. Therefore, don’t wait, setup your account ASAP!

2) Maximize the disability savings grants through your contribution

Every year the government could deposit the “disability savings grants” into your RDSP account. The amount will vary depend on your family net income and the amount of your contribution. You may also retroactive the grants from the previous years. Each year, you will receive a letter of entitlement from the government, where it states how much of your contribution is needed in order to maximize the grants for the year. As I stated earlier, RDSP is really for long term savings, budget for yourself so you would not need to access the money in your RDSP account in the short run.

3) Build a well-diversified portfolio that match your needs and risk tolerance

Invest your money wisely. From time to time, I hear people saying which particular investment is hot right now. Many people believe they could time the market based on what they read on the news. But let’s stop and think for a minute, if we could profit simply by following what it’s being reported on the news, shouldn’t the person who wrote the news be the richest guy? Remember what is your main investment objective! Are you here to place a huge bet with your RDSP money? or you’re here to grow your money with a systematic approach and calculated strategy.

I personally do not, nor have the ability to time the market for my clients. (In fact, I don’t believe there are too many people who could successfully do that over the long haul). However, I will customize a well diversified portfolio with the proper asset allocation that fit into your objective and risk tolerance.

To get start in designing your customized portfolio, simply fill out the questionnaires through the link below.

https://samuelconsultant.com/investment-questionnaires/

4) Renew your disability tax credit on time

Disability tax credit is one of the major requirements for having a RDSP account. Although all RDSP beneficiary should already have their DTC approved, since everyone’s disability condition are different, some are approved on a permanent basis, while others are temporary. Therefore, you should keep track of when your DTC will be expired, and re-apply for it at least 6 months before that. According to the feedback from my client, they find the re-applying progress to be a lot smoother when they ask the same physician to fill out the application for them again.

5) Remember to file your tax

The disability savings grants and bonds are calculated based on your family net income. Therefore, make sure you file your tax every year. For minor beneficiary, the family net income is that of his or her parents, while beneficiary over the age of majority, the family net income is that of the beneficiary and his or her spouse, if applicable.

6) Re-submit the government grant and bond application at age 18

When the beneficiary reaches age 18, a new set of government form is needed in order to continue receiving the “Canada Disability Savings Grants and Bonds“. If the disabled person has the ability to make rationale financial decision, he/she could choose to become the RDSP account holder. If not, the existing account holder could continue managing the account.

7) Fill out the standard form when transferring between financial institutions

If you want to transfer your existing RDSP account to another financial institution, please do NOT withdraw the funding within the account and re-deposit into the new one. This withdrawal will trigger the clawback of government grants and bonds, and also have taxation impact. To avoid the above impacts, you should fill out the form (HRSDC EMP5499), and provide that to your new financial institution. (Note: some financial institution might charge a fee when you transfer out your account from them)

8) Work with a knowledgeable advisor

The RDSP was first launched in 2008, it is still a relatively new and complex program. Yet, many financial institutions can administer this plan, unfortunately, very few of their branch staffs could really understand the ins and outs of it. As every decision could potentially affect your financial well-being in the long run, working with a professional advisor who truly specialized in managing the RDSP is essential. When you first meet your advisor, here are some questions you might want to ask:

- How many families have you helped in managing their RDSP account?

- How do I maximize in receiving the government grants?

- When can I withdraw the money so there will be no clawback on the government grants and bonds?

Remember the more questions you ask, the more you could understand about your advisors. Trust is always being built through greater understanding.

- Disclaimer:

- The above is for general information only, do not intend to provide any specific advice. Although, the information is being written as the best as I could, it is not guaranteed to be completely error-free, and it is subjected to change without further notice. As everyone’s situation is different, please consult a financial professional before making decision.

- Image Courtesy stockimages/ FreeDigitalPhotos.net